Reach new heights

with your health plan

professionalism. We understand the complexities of

health plans and leverage our knowledge to maximize

your healthcare spend.

When you join us at the table, you’ll experience a new

level of cost savings, control and customer service.

We have a plan for you.

APA offers a range of healthcare solution options so you can choose the best fit for your unique employee population.

Your location, your industry, your size…these are just some of the factors that will drive the right choice for you.

Network Solutions

Network Solutions

We partner with national and regional networks to give members access to healthcare providers that meet their needs. This includes physicians, hospitals, labs and other ancillary services.

Our high-performance network partners support the choice, quality and cost-effectiveness that your employees expect, no matter where they are in their healthcare journey.

Partner Health

Systems

Specific providers within defined

geographic areas that support

plan efficiency and a quality

healthcare experience for members.

Affiliated Health

Systems

Choices include in-network and

out-of-network (OON) care that can

affect plan savings and member

out-of-pocket (OOP) responsibilities.

Open Access Programs

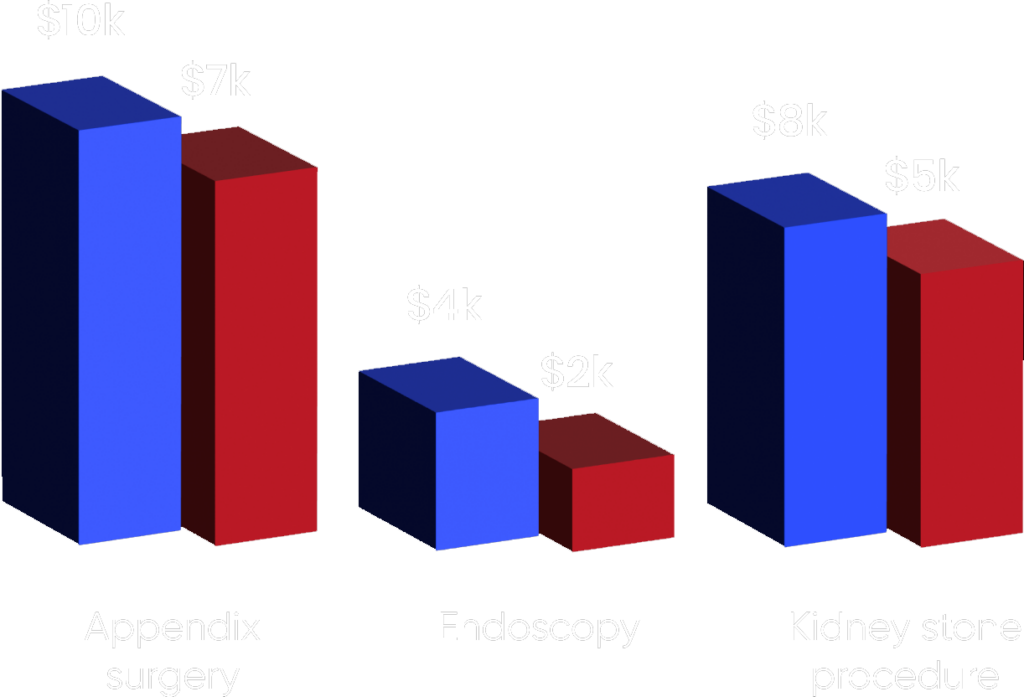

Nationwide, employers are amping up the performance of their self-funded health plans with Reference-Based Pricing (RBP). While large insurance carriers typically discount healthcare charges that are oftentimes variable and inflated, RBP uses the actual cost of the service and the Medicare reimbursement amount as reference points to determine the provider’s reimbursement. With the addition of a fair profit margin as part of the calculation, this “bottom-up” reimbursement amount results in significant cost savings for the health plan.

With RBP, the absence of a Preferred Provider Organization (PPO) or network removes geographic and health system boundaries for members, giving them the freedom to choose where they obtain care.

An RBP open access program can be enhanced even further by establishing direct contracts with select providers. APA works closely with RBP experts to design the most beneficial and cost-effective plan design for your self-funded solution.

Numbers from the past decade*

don’t add up for employees

Save up to 30% on

healthcare costs with

RBP vs. PPOs.

More reasons to add RBP to

your self-funded health plan

SAVINGS

Maximum cost savings compared to

PPO models; savings that can be

reinvested into your business

ACCESS

Direct contracts and negotiations

with providers nationwide for quality

access and cost savings

LOWER OOPs

Reduced premiums and out-of-

pocket (OOP) costs for members

MEMBER SUPPORT

Care guidance, support and

advocacy to help members get

the most from their health plan benefits

Risk Management

Stop-Loss coverage is designed to cushion self-funded health plans from unanticipated healthcare costs like high-dollar claims and costly chronic conditions. APA’s strong relationships with risk management professionals and A-rated Stop-Loss insurance carriers guarantee competitive rates and further support health plan cost savings.

Along with the flexibility, savings opportunities and increased control of self-funding your health plan, there also is some added responsibility. APA addresses the financial risks of managing your healthcare funds and protects your assets with Stop-Loss insurance.

Confidence in your Stop-Loss Coverage

APA underwriting partners will analyze and evaluate your unique population data to identify your needs and optimize coverage. Along with experienced risk management experts and carriers, we’ll guide you in setting risk limits and protection policy terms that are appropriate for your plan.

Specific Stop-Loss

Protection

Coverage on large, catastrophic claims

from a single individual. The insurance

carrier reimburses the employer health

plan if the individual’s claims exceed

the deductible.

Aggregate Stop-Loss

Protection

Coverage on the frequency of claims across the entire population of the covered plan under a set deductible. The insurance carrier reimburses the employer health plan for claims that exceed a predetermined claim dollar amount.

Maximize your self-funded

plan with APA.

Your helping hand in healthcare.